I am one of those “foreign devils” that made money out of my put options, but, to be frank, I shorted Chinese stocks long before the market tanked and I seriously started to doubt if my bearish instincts were fooling me when the market just kept going up and up. Bill Bishop of the Sinocism Newsletter kept talking up the market and as a devout reader of his newsletter, I started to think I was too pessimistic. Perhaps it was my distrust of the Chinese Communist Party that kept me from joining the madness. There always seemed a whiff of central planning behind the hysterical talking up of the market in the spring of this year, so I kept on shorting. I can only congratulate myself on my market insights for so long, though, because now my worry is about the effects of this stock market plunge on the larger economy and the spillover to Hong Kong and the rest of Asia.

China’s stock markets are mostly a mom and pop playground, since around 80% of the trading in Shanghai and Shenzhen is done by Chinese individuals, mostly those who went looking for an alternative to the previous boom, that of China’s real estate. The group is not large by Chinese standards, but the amount of stock traders outnumbers the number of Communist Party members, as I mentioned in an earlier HKFP piece. Nevertheless, there’s little doubt the effects of this downturn will be felt globally in time. After all, Chinese investors have lost more about $3.4 trillion in equity value from the markets’ mid-June peak.

The first impact will be on the privately held listed companies in mainland China that do business with foreign companies, or that are partly held by Hong Kong investors. The government is helping out the massive state-owned companies (SOEs), but private companies are hanging out to dry now. As of July 8, about half of the stocks that traded in Shanghai and Shenzhen have voluntarily halted trading indefinitely. This puts on hold everything from corporate expansion plans and salary hikes for employees – a worry for a government that wants to boost domestic consumption, but also for a Hong Kong financial system that deals regularly with mainland companies wishing to expand.

Direct exposure is another worry, albeit a fairly small one. Nevertheless, foreign banks have lent over $1 trillion to Chinese public and private companies, with the majority of that concentrated in Hong Kong, UK and US lenders. Foreign hedge fund investors, meanwhile, have billions of dollars in exposure to China stocks through direct investment and Exchange Traded Funds. Less than two months ago, many were racking up double-digit annual returns, thanks to the stock market bubble. While some had started to speak of “frothy” valuations in May, others felt the China growth story was strong. That latter group is now tasting the bitter fruit of the rout.

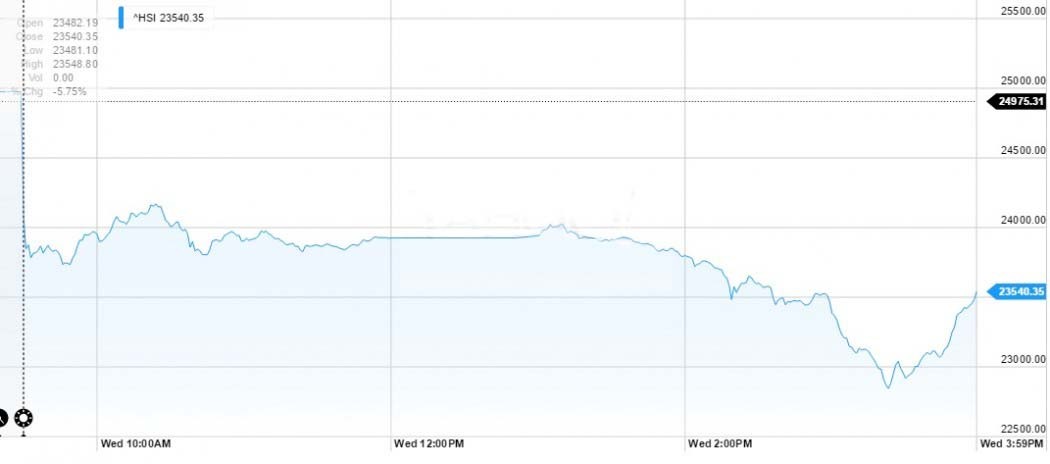

Hong Kong remained the top investment destination for wealthy mainlanders last year, and Chinese investors’ stock market losses are sure to bite here. But a bigger concern than property or shopping is the effect on businesses in Asia’s financial capital. Hong Kong’s stock markets have already been whip-sawed by money from China in recent months, and as China’s markets sank, they have too.

On Wednesday, Hong Kong’s Hang Seng index plummeted more than 8%, to its lowest level since the Shanghai-Hong Kong Stock Connect, linking Hong Kong and mainland markets, opened. It was the index’s worst one-day performance since the financial crisis of 2008. Stocks of Hong Kong-based banks and brokers are plummeting, and dozens of Hong Kong stocks have voluntarily suspending trading as well to try to sit out the downturn—putting their own expansion plans and company operations at risk.

The most lasting effect of this stock market downturn will be the international reputation of China and its knee-jerk nationalist reaction to deflect criticism of the Communist rulers. It is true that plummeting markets are putting foreign banks that have been active in China for years in a tough spot. Once welcomed into China, they are now the go-to scapegoat when China’s state media pulls a page from their Socialist agitprop playbook: Morgan Stanley was lambasted by the Global Times for urging its investors to steer clear of Chinese stocks in a June 26 note.

“Foreign devils” are easy to blame, but seeing the ugly side of China’s often wrongfully admired authoritarianism, these foreign investors might now migrate to safer places. As Hong Kong is often a springboard for foreign companies looking to do business with the mainland, this could affect the island’s financial sector not only in the short term, but for some time to come.

Chinese media’s aggressive reporting on foreign short-sellers is a big headache for investors bullish on the Chinese model. “It certainly looks like the authorities are putting some of the blame on short-sellers and even foreign conspirators,” David de Grandjean, China watcher at the Dutch Rabobank, tells HKFP. “This will delay the necessary reform in the financial market that President Xi made one of his priorities, such as an expansion of share borrowing and enlarging foreign portfolio investment, for some time. It will take a very agile CCP to win back the trust of the markets – and of the Chinese people in general. Blaming “foreign devils” alone will not do the trick.”

China’s heavy-handed stimulus measures since the markets started falling have added hundreds of billions RMB of liquidity to the market. But rather than reassuring foreign investors, they have been cutting their losses and selling off, anticipating a further decline. Tellingly, foreign exits of mainland stocks through the Shanghai-Hong Kong Stock Connect hit record highs this week, Bloomberg reported.

Of the many victims of the stock market crash, the much lauded and admired ‘Chinese System’ might be the one that is best left dead and buried. China’s economy turns out to be just like any other, with systemic weaknesses and ups and downs. It is Hong Kong’s tragic fate that its financial sector has become so intertwined with the mainland economy without the mainland adopting some of the laudable free market mechanisms of the island and with the Hong Kong Executive sitting idly by while mainland pressures undermine its rule of law. Hong Kong is in danger of being tainted by association: part “foreign devil” in the eyes of the mainlanders, part “CCP colony” in the eyes of foreigners.